Daily Nigerian Foreign Exchange Market (NFEM) Rates (₦/Us$)

Moving Average = 1,490.5248 (NFEM)

Previous Average = 1498.0354

Change = +0.5%

Forex Analysis

The naira really does seem to be on a bull run, having appreciated for like the fourth week in a row. Foreign External Reserves continue climb. This is almost certainly driven by the high interest rate regime that the CBN has maintained for some time now, which seemingly have been attracting foreign portfolio investments. Production from the Dangote Refinery would have almost certainly helped to ease pressure on foreign exchange demand. There has also been 40.5% surge in Nigeria’s non-oil revenue in the first 8 months of the year. This mostly stems from improved tax collection, which has helped to reduce government’s reliance on oil exports for funding its budget. This diversification has probably attracted foreign portfolio investments as well. In the global currency markets, there has been a weakening of the dollar, most likely fed by an expectation of a federal reserve rate cut.

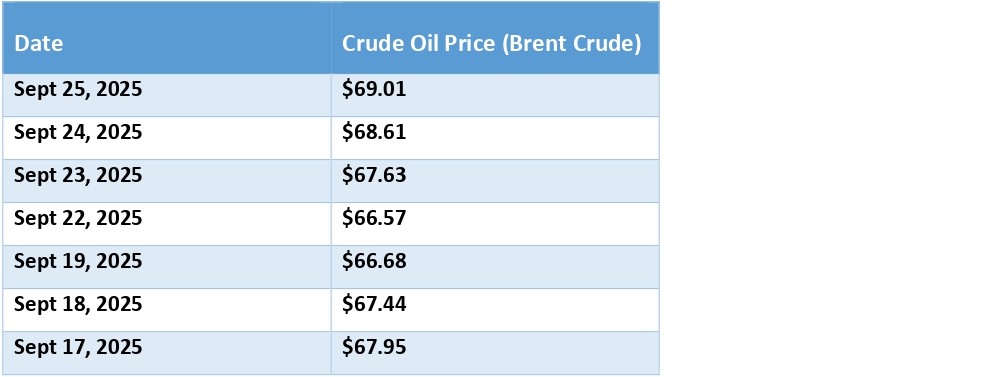

Daily Crude Oil Prices

Moving Average = $67.70

Previous Average = $67.14

Change = +0.834%

Crude Oil Analysis

Average oil prices rose by about 0.8%, despite the announcement last month by OPEC and the IEA that global demand is softening especially in the advanced economies of the west. OPEC and IEA maintain that global demand is softening, so it would seem that this week’s uptick in price is driven by short term supply dynamics, rather than it being the result of a genuine rebound in global oil demand. Possible reasons for the uptick include renewed geopolitical tensions (Russia-Ukraine) sparking speculative buying, and inventory tightness, as global oil stocks remain 67 million barrels below the five-year average, especially outside China.

NGX Top 10 Gainers For The Week Closing 26th Sept 2025

NGX Top 10 Losers For The Week Closing 26th Sept 2025

Stock Market Index Activity For The Week Closing 26th Sept 2025

Stock Market Index AnalysisThirty-two (32) equities appreciated in price during the week, lower than forty (40) equities in the previous week. Fifty-one (51) equities depreciated in price, higher than forty-one (41) equities in the previous week, while sixty-four (64) equities remained unchanged, lower than sixty-six (66) recorded in the previous week.This week saw a significant shift in investor sentiment compared to last week. The shift is likely driven by investors looking to lock in profits after a bullish run. Interest rates also remain high making the bond market attractive. We have also entered corporate earnings season. Mixed earnings reports from listed companies may have dampened enthusiasm, leading investors to reassess valuations and growth prospects. On the global level, hawkish signals from the US Federal Reserve and rising global bond yields triggered a risk-off mood globally. The impact of this is often felt first by emerging markets like Nigeria.

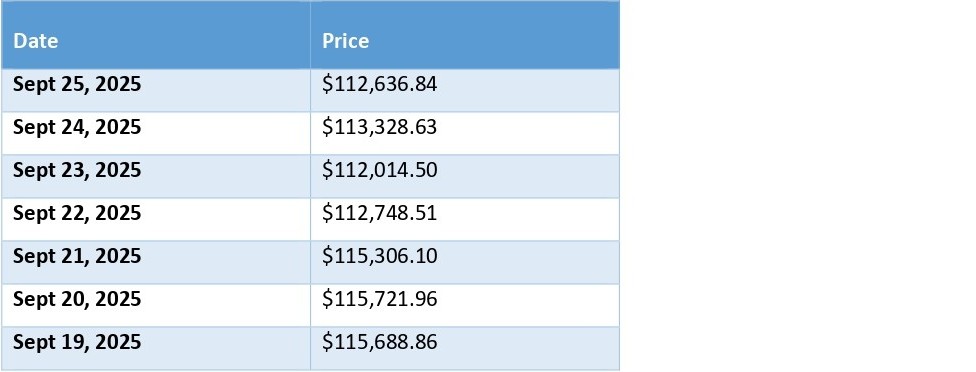

Daily Bitcoin Prices

Moving Average = $113,920.7714

Previous Average = $115,726.3714

Change = -.1.56%

Bitcoin Analysis

The 7-day moving average for bitcoin dropped about 1.6%. September has been historically bitcoin’s weakest month as portfolio rebalancing and regulatory announcements tend to hit the crypto market hard this period. There has been an announcement by the Fed chairman signaling that interest rates will remain elevated. That has a tendency to dampen appetite for risky assets like crypto.

Professional corporate finance and consulting services

barnabyandedgar.com/